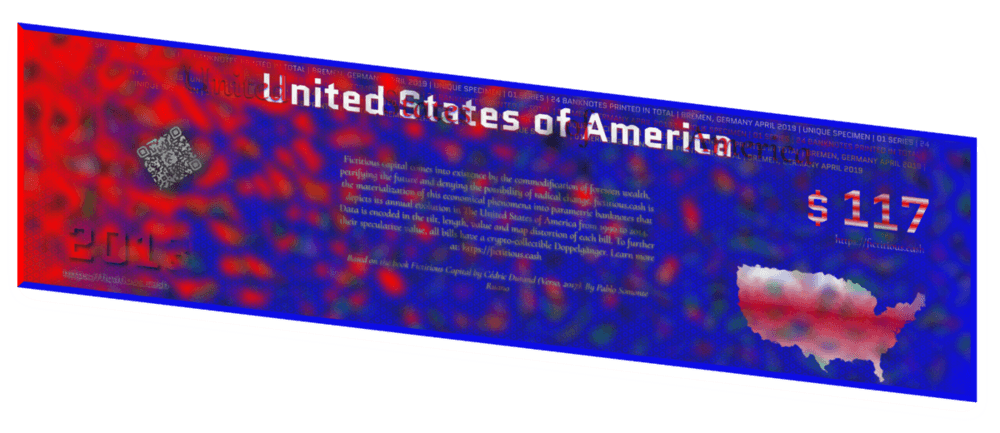

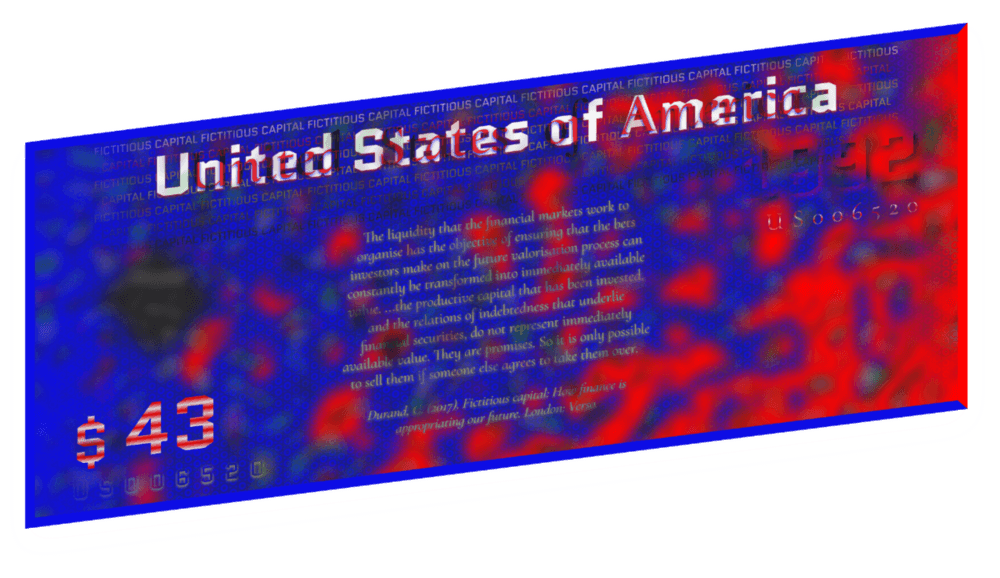

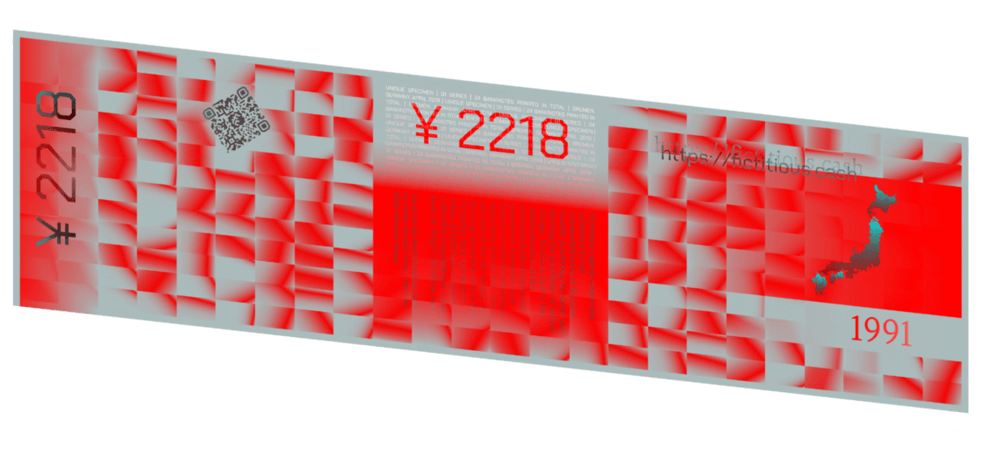

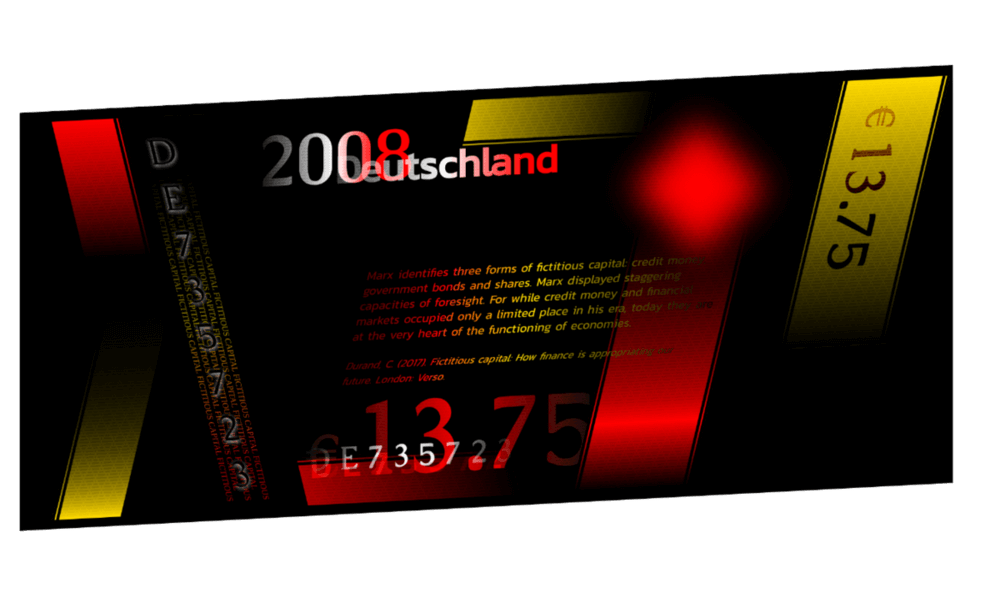

fictitious.cash is a series of 70 data-driven generative banknotes depicting the evolution of fictitious capital in Germany, Japan and the United States of America. Fictitious capital describes money that is thrown into circulation as capital without any material basis in commodities or productive activity (Harvey, David, 2006). Data of this phenomena is encoded in the tilt, length, value and map distortion of each bill. Various security measures embed in the design act as anti-forfeiture measures to assure its originality and uniqueness.

Based on the book Fictitious Capital: How Finance Is Appropriating Our Future by Cédric Durand (Verso, 2017).

Fictitious capital comes into existence through the commodification of anticipated wealth. This temporal reachout petrifies the future and neglects the possibility of radical change. Interests on loans, public debt and stock speculation are all premeditatedly priced-in and packaged as financial products available today for those with access to excess capital. Calculating risk and reward, financiers, renters and investors play a game whose theories lay concealed behind jargon, opaqueness and complexity.

The consequences of an erroneous prediction may make billionaires lose millions, but the real losers are those whose labour produce use-value at the end of the production chain. fictitious.cash is an attempt to materialize this fiat fiction by appropriating the form of the most common material medium for transfer of value: paper money. Itself also a form of fiction, its existence is intertwined with financialization, yet its presence (or absence) defines the material reality of people across cultures.

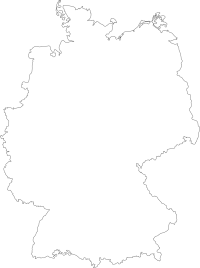

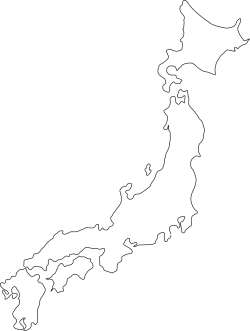

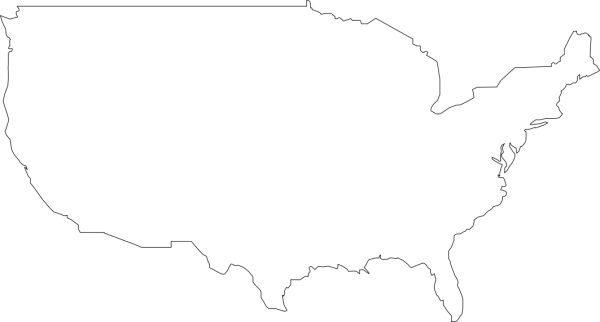

Fictitious capital is originally a Marxist concept that describes money that is thrown into circulation as capital without any material basis in commodities or productive activity (Harvey, David, 2006). Based on the data and investigation in the book Fictitious Capital: How Finance Is Appropriating Our Future by Cédric Durand (Verso Books 2017), a series of 70 banknotes depict the evolution of fictitious capital from 1990 to 2014 in three countries: Germany (from 1992), Japan and the United States of America. Each with their own variant of capitalism, these nation states reflect the trajectory of industrialized nations towards financialization as the main source of revenue for financial and non-financial companies alike. With a tight relation to globalization, the extraction of value from developing nations serves as the main fuel for the continuation of this fictitious growth. At home, companies are expected to maximize investor-revenue with less and less reinvestment, adding layers of fictional value through initial public offerings, stock buybacks, and speculation.

Cash is money in the physical form of currency. Banknotes are paper or plastic notes made by a bank and recognized as legal tender. Once redeemable for precious metal but now only backed by the common trust on our financial institutions, fiat money is as fiat as ever. The complexity of the designs and the mixed media commonly used in their manufacturing act as anti-forfeiture measures preventing their unlawful reproduction.

White or invisible UV ink, holograms, serial numbers, embossing, complex data-driven textures and microprinting are all part of the design language of paper money. In everyday use, it is enough for forfeited cash to look and feel like real money to become real. In a performative manner, its exchange-value derives from the tactile and visual experience of handling paper banknotes.

The fictitious cash manufactured for this project utilizes the data from Cédric’s book to affect the form and content of each banknote. Gross value added by financial and insurance activities (% of GDP) is divided by 10,000,000 and then converted to local currency (with exchange rates of 1:0.89 for Euros and 1:111 for Yens) to assign the denomination for each banknote in local currency. The total weight of the three basic forms of fictitious capital (% of GDP) determine the aspect ratio of the bill and the financial and insurance activities gross operating surplus (% of total) determine the degree of tilt. On the back, a distortion of the countries’ map reflects the ratio of financial revenue for non-financial domestic companies. Finally,a selection of quotes from Cédric Durand’s book are printed in the bill. The banknotes are also accompanied by a series of custom security measures: a unique serial number, pressure embossing, UV-ink stamp and a hologram are utilized to ensure the authenticity of the printed money.

The bills are parametrically designed using HTML, CSS, JavaScript and rendered to a pdf file. The prints are made at a high resolution of 1200 ppi on a 200gr, matt fiber, photo quality Hahnemühle paper, and printed on a six-ink printer.

How to read the data in the bills &

Physical Security Measures